Software Monetization—The Needs of Today

Software vendors have long relied on traditional software monetization models, such as perpetual licensing, as the core of their business strategy. As the popularity of perpetual licensing declines and the market looks toward new ways to consume and deploy licenses, vendors are being forced to rethink their monetization strategy. This has been further compounded by the now-standard adoption of cloud and mobile technologies as a part of people’s everyday lives. Customers increasingly access software beyond the physical boundaries of offices and homes on a variety of devices. Nevertheless, the need to protect the proprietary intellectual property against theft and reverse engineering still exists.

Given this background, vendors need to more quickly adapt to the evolving buying and consumption patterns of their customers without losing operational efficiencies and enabling automation.

The following primary areas of software monetization encapsulate the needs of organizations in today’s software world:

>Secure Licensing and IP Protection

>Back-End Integration and Automation

Flexible Business Models

Customers are demanding new ways to purchase and consume software. This is driving organizations to find creative ways to offer their products and services to satisfy the demands of their customers, and to give organizations an edge over their competitors. Sales organizations need to leverage feature-level offerings, as this directly influences how flexible a product’s business and license models must be.

The more traditional licensing metrics, such as perpetual licenses, seat-based metrics, machine-based licenses, and even volume or site-license concepts are becoming less commonplace. There is a notable shift toward recurring revenue models. The first step toward a recurring revenue-based approach is usually with subscription-based pricing. In this model, customers no longer purchase products outright, but pay an ongoing fee, usually on a monthly or an annual basis.

Most of the recurring revenue models are targeted for usage-based billing. With this model, customers pay only for what they use, and, in many cases, any limits on the number of users or capacity are eliminated altogether. For an increasing number of organizations, this is considered the ultimate recurring-revenue goal.

Usage Insight

When organizations start to plan usage tracking, the initial focus is usually on data accumulation. Typically, the longer-term vision is to build a pricing and billing strategy based on usage metrics. Accumulated data also has significant value from the perspective of business intelligence (BI) and analytics. Usage data provides a comprehensive view, especially when it is used alongside activation data. The data shows organizations exactly what happens after products are activated. This data also helps in understanding which features and modules are the most popular, versus which have the lowest levels of demand. In addition, the data can also create a geographical picture of how products are used across different regions.

Secure Licensing and IP Protection

The original driving force of software licensing continues to be a part of the goals of organizations toward greater compliance and safeguarding investments. Even though the choices are still preferred on the types of protection and measures applied—hardware or software-based mainly—the need to deter illegal use and attacks and protect intellectual property exists. Organizations want protection to be secure yet to save time and money with less manual work.

Back-End Integration and Automation

While being able to offer flexible and usage-based business models is a key to success, it is also essential to focus on gaining operational efficiencies along with delivering a positive customer experience. In fact, the task becomes substantially harder when vendors are wrestling with multiple home-grown systems, manual processes, and a lack of integration between multiple installed systems.

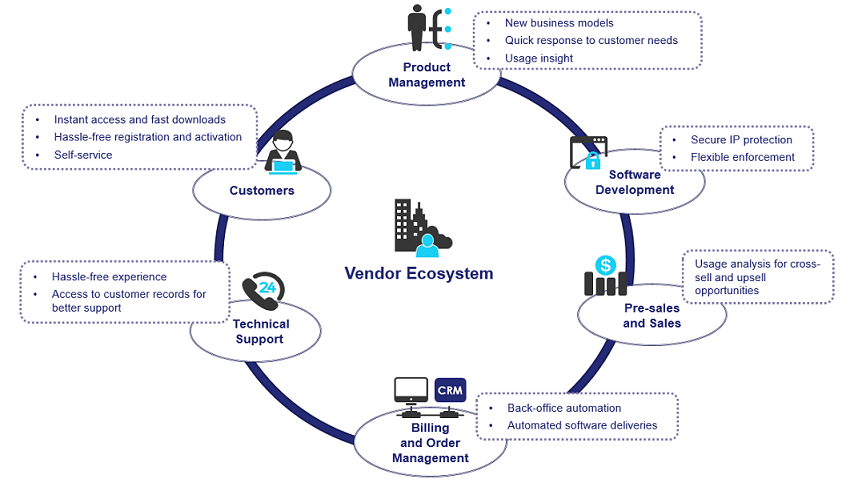

The diagram below summarizes the typical challenges faced by the various stakeholders that take part in the entire licensing lifecycle and delivery chain, including: product management, software development, sales and marketing, order management, fulfillment and delivery, and technical support. If not addressed, these challenges will have a direct impact on customer experience and operational efficiency, and will stifle businesses' ability to evolve.

A common challenge faced by organizations is that their back-office and fulfillment infrastructure are too inflexible to allow the changes in license and business models to be implemented. Having all the flexibility and capability in product licensing offers little benefit unless that flexibility also exists in the back office. This often limits the choices and options available with the products and solutions because the structure of the back-office environment cannot accommodate anything more complex.

Software vendors are now starting to move toward a holistic platform that automates the fulfillment and delivery processes and also provides self-service capabilities though comprehensive end-user portals. Connecting systems together allows for automation, which is a key enabler in an efficient and resilient back-office fulfillment process. License key generation capabilities need to be integrated with other back-office systems, including CRM and ERP, customer support and financial and product delivery systems. To be successful, this initiative must produce value to the various stakeholders that participate in the entire licensing lifecycle and delivery chain.

In the following sections, you will learn how Thales's software monetization solution can help vendors like yourself to address these challenges. You can simplify licensing by introducing new business models, automating the entire back-end operation, and offering insights into customer usage for informed decision making.